Accounting Software That Meets IRD and VAT Rules in Nepal

Stay IRD and VAT compliant with smart accounting software made for Nepali businesses. Automate invoices, tax reports, and financial records with ease.

For any business operating in Nepal, staying compliant with government tax laws is not optional its a necessity. The Inland Revenue Department (IRD) has strict guidelines for VAT billing, TDS deduction, and financial reporting. Failing to meet these requirements can result in penalties, audits, or even legal trouble.

To avoid these risks and simplify your financial processes, many businesses are now turning to accounting software that is fully compliant with IRD and VAT rules. These tools not only reduce manual work but also ensure that your invoices, reports, and tax records are accurate and up to date.

In this blog, well explain why IRD-compliant accounting software is essential for Nepali businesses, what features to look for, and how it can help you operate more efficiently and legally.

Why IRD Compliance Matters

The IRD requires all VAT-registered businesses in Nepal to:

-

Issue VAT-compliant invoices

-

Maintain digital records of sales and purchases

-

Deduct and report TDS (Tax Deducted at Source) where applicable

-

Submit monthly tax reports and return filings

Manually handling these requirements can be time-consuming and error-prone. Using software that automates these processes helps you save time, reduce mistakes, and meet every deadline confidently.

Benefits of Using IRD-Compliant Accounting Software

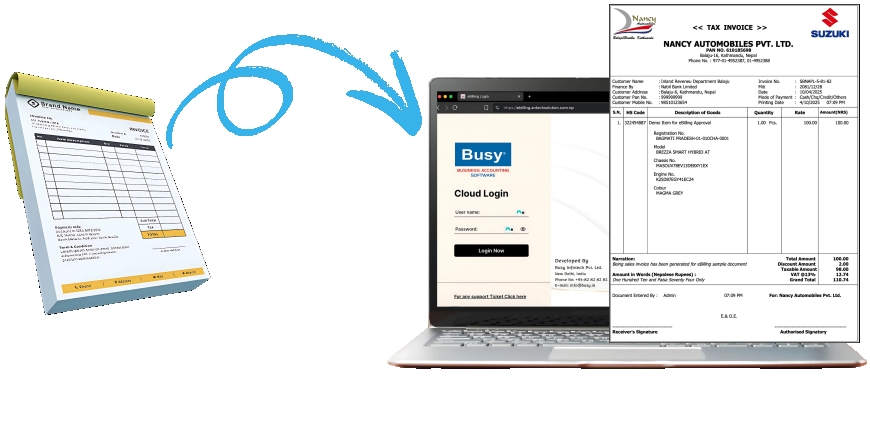

1. Generate VAT-Compliant Invoices

Good accounting software formats your invoices according to IRDs specifications, including:

-

PAN/VAT numbers

-

Invoice serial numbers

-

Tax breakdown (VAT amount)

-

Customer and supplier details

-

Itemized billing

This ensures that your invoices are accepted during audits and inspections.

2. Auto-Calculate VAT and TDS

Instead of manually calculating taxes on every sale or purchase, the software automatically:

-

Applies the correct VAT percentage

-

Deducts TDS based on rules

-

Updates totals in real-time

-

Tracks amounts due for return filing

This minimizes the risk of under-reporting or overpaying taxes.

3. Prepare IRD-Standard Reports

VAT returns, sales summaries, and purchase details are automatically generated in formats accepted by the IRD. With just a few clicks, you can export:

-

VAT sales and purchase reports

-

TDS reports

-

Purchase ledgers

-

Profit and loss statements

-

Balance sheets

These reports are ready for submission during audits or regular tax filings.

4. Reduce Human Error and Save Time

Mistakes in tax reporting can lead to penalties or delays. Accounting software eliminates errors in calculations, improves accuracy, and frees up your time for actual business operations.

5. Stay Updated with Changing Rules

Nepals tax laws and IRD formats are regularly updated. Reliable accounting software providers offer updates to keep your system aligned with the latest rules so youre always compliant.

Who Should Use IRD-Compliant Accounting Software?

Whether you're a small startup or an established enterprise, IRD-compliant software is a must if:

-

You are VAT-registered

-

You need to deduct and report TDS

-

You want to generate legal invoices

-

You need to prepare regular financial reports

-

You operate in retail, wholesale, services, or manufacturing

Common users include:

-

Shops and stores

-

Travel and trekking companies

-

Hardware and construction businesses

-

IT service providers

-

Training institutes and consultancies

Key Features to Look For

When choosing accounting software that meets IRD and VAT requirements in Nepal, look for these features:

-

VAT-compliant invoicing templates

-

Automatic VAT and TDS calculations

-

Sales and purchase tracking

-

Real-time financial reports

-

Multi-user access with permissions

-

Offline and online functionality

-

Secure backup and data protection

-

Local support and training

Some tools also provide Nepali language support and dual currency options, which can be a great advantage for localized businesses.

Final Thoughts

For Nepali businesses, accounting isnt just about managing income and expenses its about following the law, avoiding penalties, and maintaining a clean financial record. Using accounting software that meets IRD and VAT rules makes this easier, faster, and more reliable.

In conclusion, using IRD verified accounting software in Nepal ensures compliance with government regulations, simplifies tax reporting, and builds trust in financial transparency.